The Labor Market Is Cooling—But Is the Economy Cracking?

The July employment report delivered what the Federal Reserve has long signaled it wants to see: a cooling labor market. But the response from markets suggests that the boundary between an orderly slowdown and something more problematic may be thinner than expected.

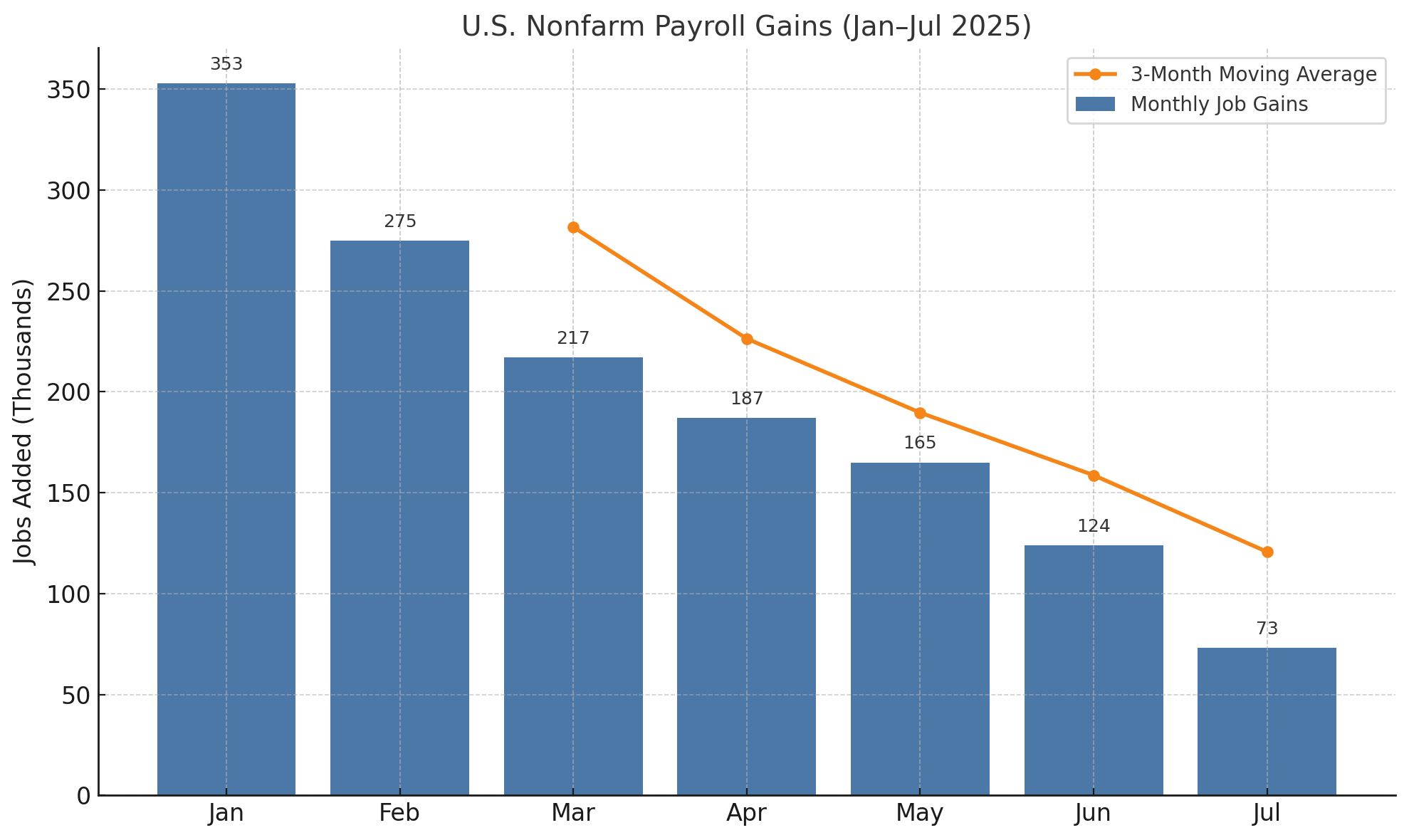

Employers added just 73,000 jobs in July, well below consensus estimates. That figure, though modest in isolation, arrives alongside substantial downward revisions to May and June — a combined reduction of 258,000 payrolls. The result: a three-month average of sub-100,000 job creation, the weakest since the pandemic-era distortions of early 2020.

For the first time in this cycle, the labor market is not only slowing — it’s surprising to the downside. That shift is triggering a reappraisal of risk across asset classes.

A trend, not an aberration

The softness in July’s report was not confined to a single sector. Gains in healthcare and social assistance — which added a combined 73,000 jobs — effectively accounted for the entire month’s growth. Elsewhere, the picture was stagnant or negative. Retail trade, manufacturing, administrative support, and government all saw headcount decline.

Crucially, the revisions to prior months suggest a labor market that began decelerating well before July. What was once perceived as a healthy glide path now looks more abrupt. This re-framing matters — not just for macro forecasting, but for the Fed’s calculus around the timing and pace of potential rate cuts.

Earnings growth diverges beneath the surface

Headline wage growth remains intact, with average hourly earnings rising 0.3% month-over-month and 3.9% year-over-year. However, wage gains are increasingly uneven. Workers earning below $806 per week — roughly the bottom quartile — have seen wage momentum fade, while higher-income earners continue to post gains above 4.5%.

The average workweek edged lower to 34.3 hours, a subtle but notable signal of declining labor intensity. Taken together, these data suggest that while aggregate earnings remain elevated, household income growth — especially at the lower end — may be beginning to erode.

Market response sharpens rate expectations

Financial markets moved quickly to reprice the path of monetary policy. Treasury yields fell across the curve, with the two-year note dropping to 4.28%. Fed funds futures now assign roughly an 80% probability to a rate cut in September — a sharp pivot from just weeks ago, when expectations had tilted toward a hold through year-end.

Equities, particularly cyclicals and financials, sold off in response. The S&P 500 declined 1.6% on Friday, while the Nasdaq fell 2.2%. Gold and defensive sectors outperformed, reflecting a growing preference for safety as the labor market narrative turns.

Despite market positioning, Federal Reserve officials struck a measured tone. Several members emphasized that while the data showed moderation, it remained consistent with a soft landing scenario. With core PCE inflation still running at 2.8%, the central bank may be inclined to wait for further confirmation before adjusting its stance.

Political risk enters the equation

Adding to the uncertainty was the abrupt dismissal of Bureau of Labor Statistics Commissioner Erika McEntarfer by President Trump just hours after the report’s release. The move — officially attributed to “data misrepresentation” — drew sharp criticism from economists and former officials, who warned of long-term damage to institutional credibility.

Simultaneously, the administration confirmed that new tariffs on imports from Brazil, Canada, India, and Taiwan will take effect in September. For investors, the policy mix now resembles a more precarious combination: softening domestic demand, elevated inflation risk, and a destabilized policy backdrop.

Looking ahead

This week brings factory orders, trade data, and key corporate earnings that may offer further clarity on both demand conditions and pricing power. But the central narrative — a labor market shifting from strength to fragility — is now firmly in focus.

The Fed’s challenge is to distinguish between deceleration and deterioration. For investors, the challenge is to position portfolios in an environment where resilience may give way to vulnerability — quietly, and perhaps quickly.